Let Go of Debt !

Embrace Family Togetherness

Reclaim your moments with your family, free from the fear of harassment and the weight of debt.

Our Prouds

Turning Debt Into Freedom

At SettledLoan, we are proud to offer solutions that turn overwhelming debt into a path toward financial freedom and happiness.

Debt Handle

Client Satisfied

Client Conversion

Customers

Real People. Real Success.

Thousands have broken free from debt with SettledLoan. Now its your turn!

What is #DebtFreeIndia Movement?

The India Debt-Free Movement is an initiative aimed at empowering individuals across the nation to overcome financial distress, eliminate debt, and achieve financial freedom. This movement seeks to raise awareness about the importance of responsible financial management, debt reduction, and the tools available to help individuals and families regain control of their finances.

By providing education, resources, and expert guidance, the India Debt-Free Movement focuses on helping people get out of the cycle of debt, whether it’s personal loans, credit card debts, or business-related financial struggles. The movement promotes solutions such as debt consolidation, settlement, and financial counseling to make debt repayment more manageable.

Our Debt Relief Services

Loan Settlement Services

We’ll work with your creditors to negotiate better terms, so you can settle your debts for a lower amount than you owe. Our team handles all the communication and paperwork, ensuring a stress-free experience.

Financial Consultation

Credit Score Improvement

Negotiation with Multiple Creditor

Legal Support

Harassment Protection

Debt Management Plans

Emergency Debt Relief

98% Satisfaction Rate

Secured Payment

24*7 Support

Trusted by 5K+ Individuals

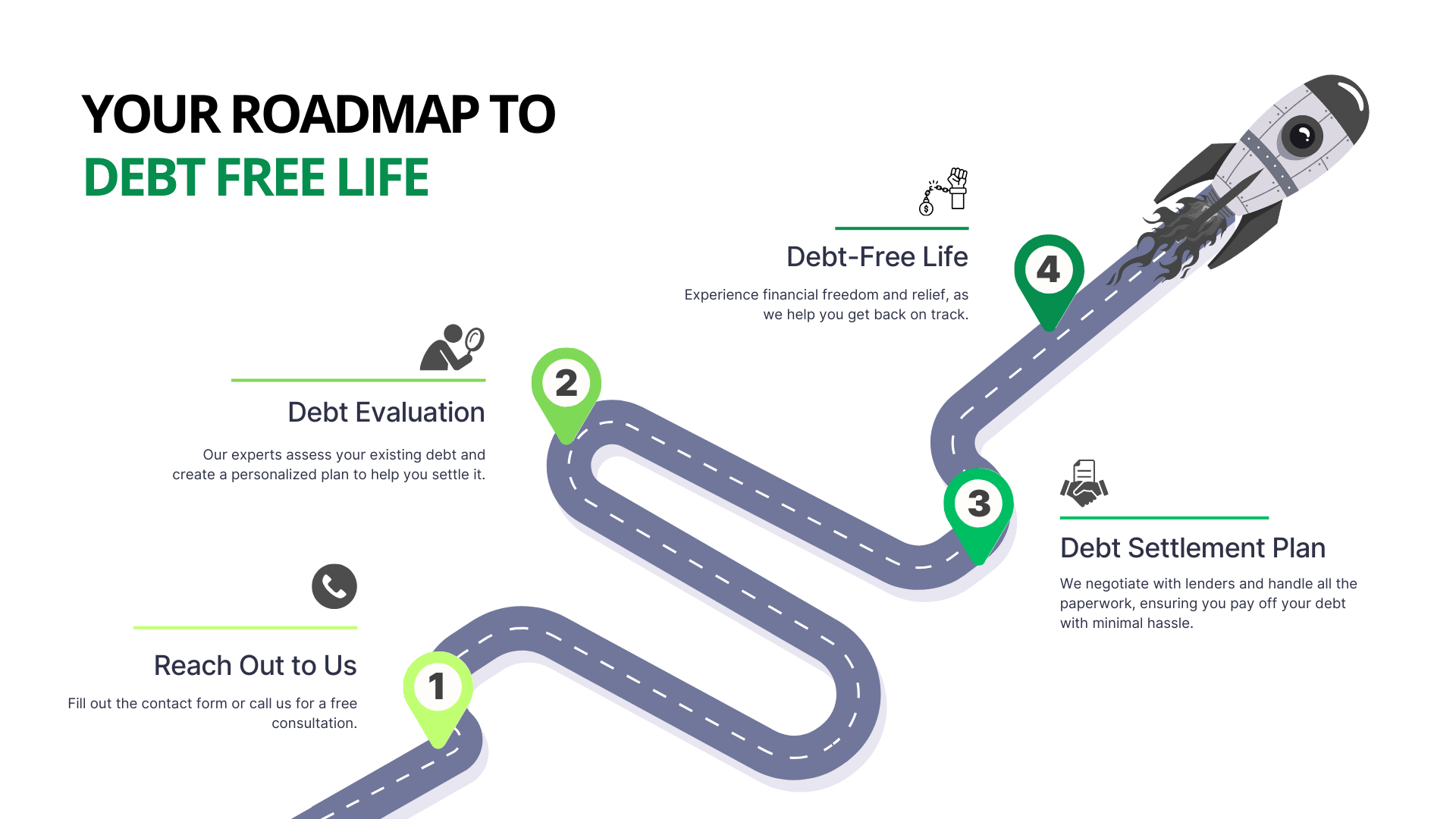

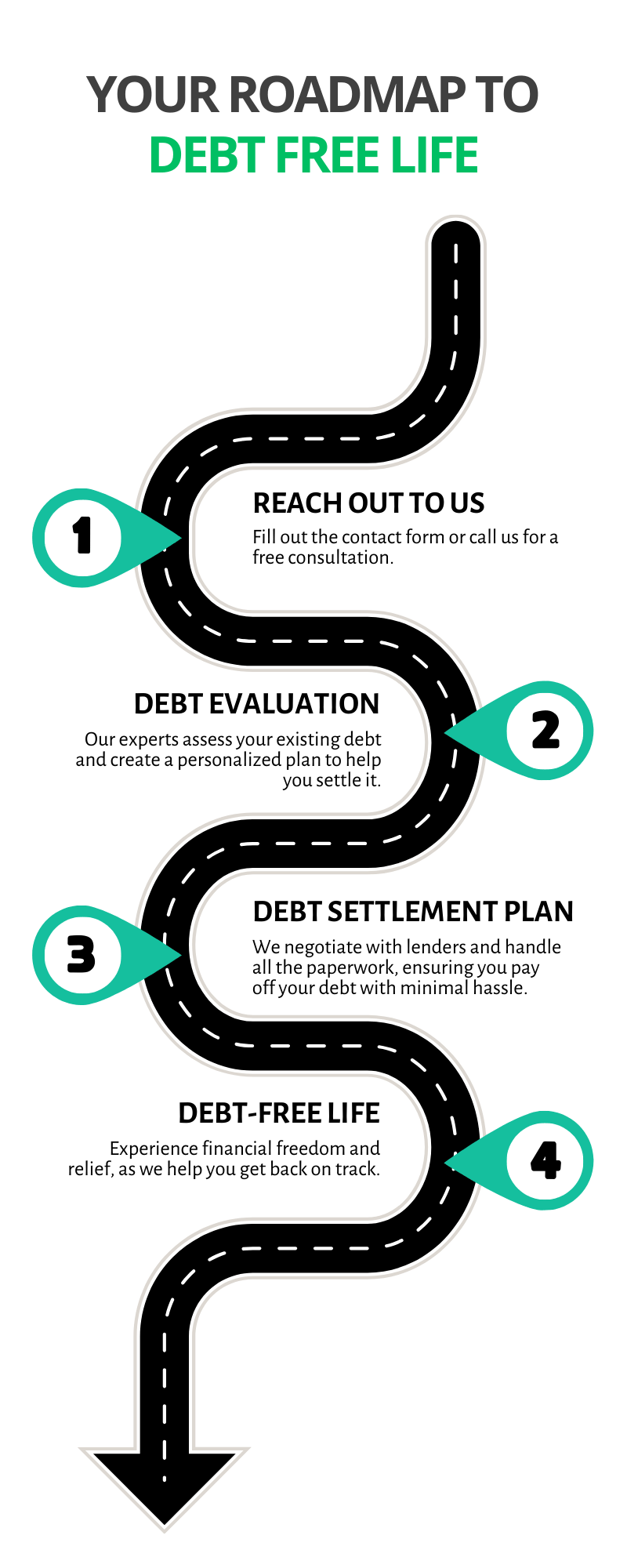

Settled Loan Program Benefits

Fastest Settlement Process

It takes an average of 24 months for our customers to become free from debt trap which they cannot pay even in 5 yrs. Our Settlement program is the fastest process to become debt-free.

Reduced Debt

with our settleloan program you can save a lot on your total outstanding debt, including paying our fees you can save some of the outstanding debt that you owed from the lenders.

Handling all calls and harassment

Our Settlement program will also help you to live a stress-free life as you can forward all your lender’s calls to our team to handle all harassment calls.

Debt Relief is more accessible than you think!

Address

B, 74, B Block, Sector 2, Greater Noida 201301

Settledloan@gmail.com

Phone Number

+91 80767 84568 / +91 (931) 506-2902